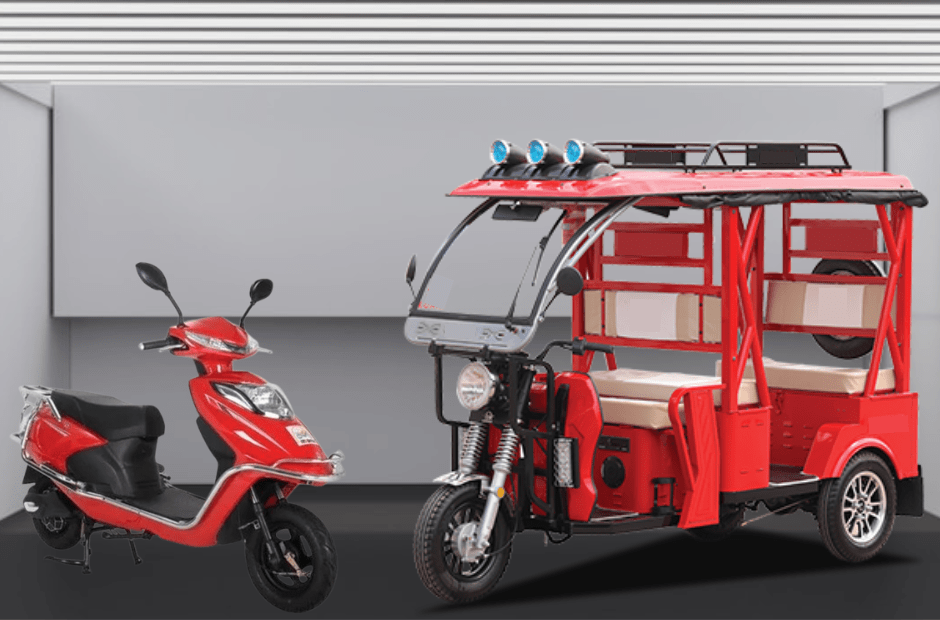

Our Offerings

Microfinance is a way to provide capital to low-income business owners who may be excluded from traditional credit and lending options.

30,000+

Loan Approval

₹35,00,00,000+

Disbursement

How it Works?

We have a fast and easy application process.

Apply for loan

Apply for your desired loan.

Application review

We will review your application and complete the verification process.

Get funding fast

If approved, get your funds fast.

Frequently asked questions

Contact Us01. What is microfinance?

Microfinance refers to the provision of financial services to low-income individuals or groups who lack access to traditional banking services.

02. Who can apply for microfinance?

Microfinance is generally targeted towards small business owners, farmers, artisans, and others who are looking for small loans to start or expand their businesses.

03. What is the purpose of microfinance?

It is aimed at enabling low-income individuals to become self-sufficient and to improve their livelihoods by investing in their businesses, education, and other areas of their lives.

04. What are the different types of microfinance products available?

The different types of microfinance products available at Samarth Micro Capital includes: Micro business loan, personal loan, group loan and other micro loan.